Introduction

Investing in precious metals through an Individual Retirement Account (IRA) can offer a robust hedge against inflation and diversify your retirement portfolio.

However, the cornerstone of maximizing the benefits from such an investment lies in selecting the right custodian.

This guide aims to demystify the complexities surrounding the selection process of a custodian for your precious metals IRA.

Covering everything from the foundational understanding of what a custodian is, to advanced considerations and troubleshooting, we embark on a journey to ensure you move forward with confidence in securing your investment’s future.

Table of Contents

What is a Precious Metals IRA Custodian?

Definition and Role of a Custodian in Your IRA

A custodian for a Precious Metals IRA is an IRS-approved institution responsible for the safety and administrative oversight of the assets within your IRA.

Unlike financial advisors who guide on which assets to invest in, custodians ensure your investments are kept safely and comply with IRS regulations.

Why You Need a Custodian for Your Precious Metals IRA

The Internal Revenue Service (IRS) mandates that all IRA assets, including precious metals, must be held by a custodian.

A Precious Metals IRA custodian is a financial institution that has received approval from the IRS to hold and safeguard your IRA’s precious metals.

They handle the purchase, sale, and storage of the metals, ensuring that your investments comply with IRS regulations. Without a custodian, you cannot legally open or maintain a Precious Metals IRA.

Legal Requirements and Responsibilities of Custodians

The custodian’s role is pivotal. They must adhere to stringent legal guidelines, ensuring your precious metals are properly stored, reported, and accounted for, thus protecting your retirement savings from unforeseen penalties due to non-compliance.

How Custodians Differ from Financial Advisors and Banks

Unlike banks and financial advisors, IRA custodians specialize in retirement accounts, offering tailored services such as secure storage options and detailed record-keeping specific to IRA investments.

The Checklist for Choosing Your Ideal Custodian

IRA Approved Precious Metals

First and foremost, ensure the custodian you choose deals with IRA-approved precious metals. These are metals that meet specific fineness requirements set by the IRS.

- For Gold, the fineness must be .995 or higher;

- Silver, .999;

- Platinum, .9995; and

- Palladium, .9995.

Reputation and Reliability: Vetting the Track Record

Ensure the custodian has a strong reputation within the industry. Look for:

- Regulatory Compliance and Accreditation: Validations such as memberships in the Industry Council for Tangible Assets (ICTA) signify credibility.

- Research the custodian’s track record: Focusing on their expertise in precious metals and their history in the financial industry.

- Customer Reviews and Testimonials: First-hand client experiences can provide invaluable insights. When evaluating precious metals IRA custodians reviews in detailed can provide invaluable insight into their reliability, customer service, fees, and security measures. Here, we’ll delve into reviews of some notable custodians.

1) Goldstar Trust Reviews

Goldstar Trust is known for its comprehensive services and competitive pricing. Customers often praise its user-friendly interface and responsive customer support. However, it’s important to weigh both positive and negative reviews to get a balanced view.

2) Strata Trust Company Reviews

Strata Trust Company emerges as a strong option with its specialized focus on precious metals IRAs. Positive reviews frequently highlight its professionalism and efficiency. Nonetheless, always cross-reference information to ensure it fits your specific needs.

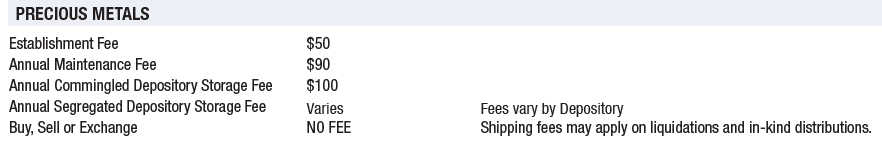

Fee Structures and Transparency

Understanding what and how you will be charged is crucial:

- Different Types of Fees Charged: Annual fees, storage fees, and transaction fees are common. Each custodian is different; compare to find the best fit.

- Comparing Fee Structures Among Competitors: This can highlight potentially more cost-effective options.

- Hidden Fees to Watch Out For: Such fees can sneak up and significantly impact your investment profitability.

Services and Support Offered

High-quality support and services are non-negotiable:

- Storage and Security Features for Your Metals: Options like segregated storage might offer more peace of mind.

- Reporting and Record-Keeping Services: Essential for keeping track of your investment.

- Customer Support and Accessibility: Good customer service is invaluable, especially in complex matters such as IRAs.

The Role of Texas Precious Metals Depository

The Texas Precious Metals Depository offers a secure and compliant solution for storing IRA-approved metals. Selecting a custodian that partners with reputable depositories like this can add an extra layer of security to your investment

Understanding Storage Options and Security Measures

Segregated vs. Co-mingled Storage

Choosing the right storage can affect your investment’s security and integrity:

- Pros and Cons of Each Type of Storage: Segregated storage ensures your metals are stored separately, while co-mingled storage might be less expensive.

- Costs Associated with Segregated Storage: Typically higher, but the added security can be worth the cost.

- How to Decide Which is Right for You: Consider factors like the value of your investments and personal peace of mind.

Insurance and Safeguarding Measures

Insurance is a safety net for your investments:

- Types of Insurance Coverage to Look For: Comprehensive insurance against theft, loss, or damage is essential.

- How Insurance Protects Your Investment: Should the worst happen, knowing your investment is insured can provide significant peace of mind.

- Verifying the Custodian’s Insurance Credentials: Ensure the custodian’s insurance is adequate and active.

High-Tech Security Features

In an era where digital threats are looming, cybersecurity measures cannot be overlooked:

- Advanced Security Technologies Employed: Look for custodians using modern security practices to protect your digital records.

- Regular Audits and Security Protocols: These help catch any irregularities and ensure the custodian remains in compliance.

- Importance of Cybersecurity Measures: Protecting your investment from digital threats is as important as physical security.

Navigating the Investment Process with Your Custodian

Opening Your IRA Account

The right custodian makes this process streamlined:

- Step-by-Step Process to Get Started: Look for a custodian who simplifies the paperwork and setup process.

- Required Documentation and Verification: Ensure you have all the necessary documents ready.

- Initial Funding and Metal Selection: Understanding your options can help you start on the right foot.

Managing Your Precious Metals Portfolio

Effective management is key to a profitable IRA:

- Understanding the Mix and Diversification: Diversifying your investments can reduce risk.

- When to Rebalance Your Portfolio: Regular reviews with your custodian can keep your investments aligned with your goals.

- Adding New Metals or Liquidating Assets: Flexibility in your investment choices gives you room to maneuver as markets change.

Planning for the Future

Looking ahead ensures your IRA contributes to your long-term well-being:

- Succession Planning and Beneficiaries: Ensure your investments are passed on according to your wishes.

- Withdrawals and Required Minimum Distributions (RMDs): Understanding IRS regulations can prevent penalties.

- Converting Precious Metals to Cash: Knowing your options ahead of time can provide liquidity when needed.

Advanced Considerations: Red Flags and Troubleshooting

Recognizing Warning Signs

Stay vigilant to safeguard your investments:

- Delays in Communication or Transaction Processing: These can be early indicators of deeper issues.

- Unexplained Fees or Changes in Agreement Terms: Always question and clarify these red flags.

- Signs the Custodian Might Be Overextended: Such signs can indicate potential risks to your investment.

Dealing with Custodian Disputes

Effective communication is often the key to resolution:

- Steps to Address Disputes Professionally: Approaching disputes with a clear, calm mindset can lead to quicker resolutions.

- When and How to Escalate Issues: Know when it’s time to seek external help or mediation.

- Options for Changing Custodians if Necessary: Sometimes, moving to a different custodian is the best solution.

Conclusion

Choosing the right Precious Metals IRA custodian is a decision that should not be taken lightly. It requires due diligence, thorough research, and consideration of both your immediate needs and long-term objectives. This guide has laid out a comprehensive pathway to navigate through the multitude of factors influencing this crucial decision. Moving forward with confidence means being fully informed and aware of your options, enabling you to safeguard your investment for the future.

Frequently Asked Questions (FAQs)

- Can I hold the precious metals from my IRA in my home?

No, IRS regulations require precious metals in an IRA to be stored in a secure, IRS-approved facility. - How often should I review my custodian’s performance and fees?

Annually is a good practice, though more frequent reviews may be needed in volatile markets or if there are significant changes in your investment strategy. - What happens to my precious metals IRA if the custodian goes out of business?

Your investment should remain safe. Precious metals are typically insured, and arrangements would be made to transfer your IRA to another custodian. - Are there any tax implications when choosing a custodian?

No direct tax implications exist based solely on the choice of custodian, but how the custodian administers your account can affect your tax situation. - How can I liquidate metals in my IRA in case of a financial emergency?

You would need to coordinate with your custodian for the sale of the metals, and the proceeds from the sale would be held within your IRA to maintain its tax-advantaged status.

Pingback: Why Transferring IRA to Gold is a Smart Move in 2024