In the evolving landscape of financial investments, Edward Jones Gold IRA emerges as a pillar of sophistication and enduring expertise. With origins deeply rooted in the challenging times of the Great Depression, Edward Jones was founded with the noble aim of helping individuals reconstruct their wealth. Today, the firm flourishes by serving a discerning clientele, offering bespoke investment opportunities, including Edward Jones Gold IRA and diverse commodities investments. This guide is meticulously crafted to illuminate the intricate offerings of Edward Jones, especially its unique stance on Gold IRA investments, alongside an exploration of its broader investment ecosystem.

Table of Contents

The Edward Jones Gold IRA Heritage: A Tradition of Excellence

A Timeless Odyssey

Bearing the moniker “TNT Brokers,” Edward Jones embarked on a mission during the Great Depression’s darkest days, committed to restoring financial stability among the populace. This mission propelled the firm to visit clients in the most remote areas, laying the groundwork for what would become a sanctuary for affluent investors worldwide, Edward Jones.

Edward Jones has established itself as a trustworthy advisor in the world of investments. With a focus on building long-term relationships, their tailored approach ensures that your retirement strategy fits your individual financial goals, including the unique benefits that a gold IRA can offer.

Delving into Edward Jones’s Investment Suite

Premium Investment Strategies

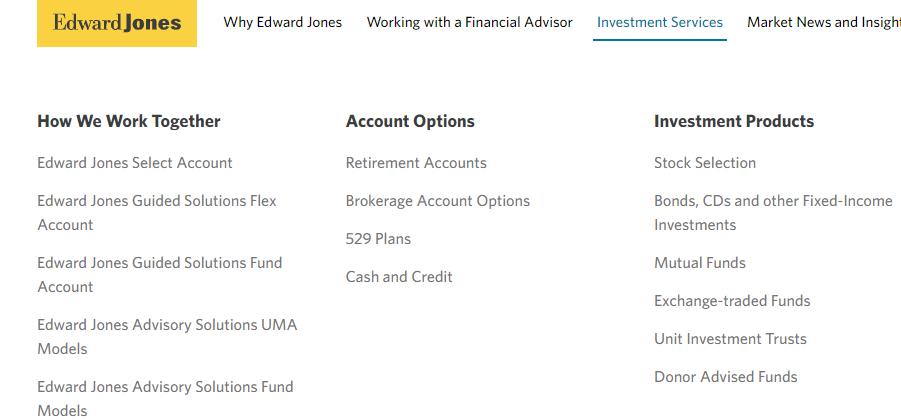

At Edward Jones, the path to investing in gold doesn’t follow the usual route of self-directed Gold IRAs. Instead, the firm paves the way for investors to engage in the gold market through alternative avenues such as gold mining stocks and gold-centric exchange-traded funds (ETFs). This strategy provides an approachable platform for those aiming to infuse their portfolios with the luster of precious metals.

A Spectrum of Investment Choices

Edward Jones gold IRA and Edward Jones commodities form just a part of the firm’s expansive portfolio offerings. From mutual funds and bonds to stocks, the firm’s array of commodities and unit investment trusts cater to the nuanced needs of its clientele. While renowned for its bespoke advisory services, it’s pivotal to note that Edward Jones’s fee structures are positioned on the higher end of the spectrum, mirroring the premium, personalized investment counsel it provides.

Why Consider Edward Jones for Your IRA Commodities?

Edward Jones is a well-established financial services firm that understands the value of building a diversified retirement portfolio. It offers a variety of investment options, including IRA commodities, to help tailor your retirement planning to your specific needs and goals. Their personalized approach to investment planning makes Edward Jones an attractive option for those looking to integrate commodities into their retirement strategy.

The Benefits of Commodities in Your Retirement Portfolio

Adding commodities to your IRA can offer several benefits:

- Diversification: Commodities often have a low correlation with standard asset classes like stocks and bonds. This means they can move differently in response to economic events, potentially reducing overall portfolio risk.

- Inflation Protection: Commodities can serve as a hedge against inflation. As the price of goods and services rises, the value of commodities usually increases as well.

- Growth Potential: Demand for commodities, such as metals, energy, and agricultural products, can lead to growth over time, benefiting your retirement savings.

How to Start With Edward Jones Commodities

- Consult With a Financial Advisor: Edward Jones financial advisors can help assess your current financial situation and retirement goals to determine if commodities are a suitable addition to your IRA.

- Understand Your Options: Commodities can be invested in directly, through futures contracts, or indirectly, via ETFs (Exchange-Traded Funds) and mutual funds that focus on commodities.

- Open an IRA Account: If you haven’t already, you’ll need to open an IRA account. Edward Jones offers traditional and Roth IRAs, among other types.

- Choose Your Investments: With the help of your advisor, select the commodities or related funds that align with your investment objectives and risk tolerance.

How to Access Your Edward Jones Login account

Accessing your Edward Jones IRA is straightforward, enabling you to monitor and manage your investments with ease. Follow these simple steps:

- Visit the official Edward Jones website.

- Look for the “Client Login” option at the top right corner of the homepage.

- Enter your User ID and Password in the respective fields.

- Click “Log In” to access your IRA dashboard.

If you’re a first-time user, you will need to enroll for online access by clicking the “Enroll” link and following the prompts to set up your account.

Maximizing Your Edward Jones IRA

Managing your IRA effectively involves understanding your options and the standards set by the IRS.

- Contribution Limits: For 2023, the total contributions to your traditional or Roth IRA cannot exceed $6,000 ($7,000 if you’re age 50 or older).

- Investment Options: Diversify your portfolio by exploring the range of investments available through Edward Jones, such as stocks, bonds, mutual funds, and ETFs.

Benefits of Managing Your Edward Jones IRA Online

Using the Edward Jones IRA login portal provides various benefits that make retirement planning simpler and more effective:

- 24/7 Account Access: Check your balance, view your portfolio, and monitor performance at any time.

- Easy Contributions: Set up one-time or recurring contributions to your IRA online.

- Portfolio Management: Adjust your investment choices based on performance, risk tolerance, and financial goals.

- Financial Tools and Resources: Utilize calculators, market news, and advice to make informed decisions.

Discovering Alternatives: Opting for Gold IRA Specialists

A World of Options

For investors drawn to the allure of Gold IRAs, the market presents a variety of specialists such as

These entities specialize in Gold IRAs, offering custom solutions known for their exceptional experience and high customer satisfaction levels.

The Crucial Role of Custodians

Gold IRA custodians are the linchpins in the world of precious metals investments, responsible for the secure storage and meticulous management of these assets. Their role is indispensable, ensuring adherence to IRS guidelines and the protection of investors’ portfolios.

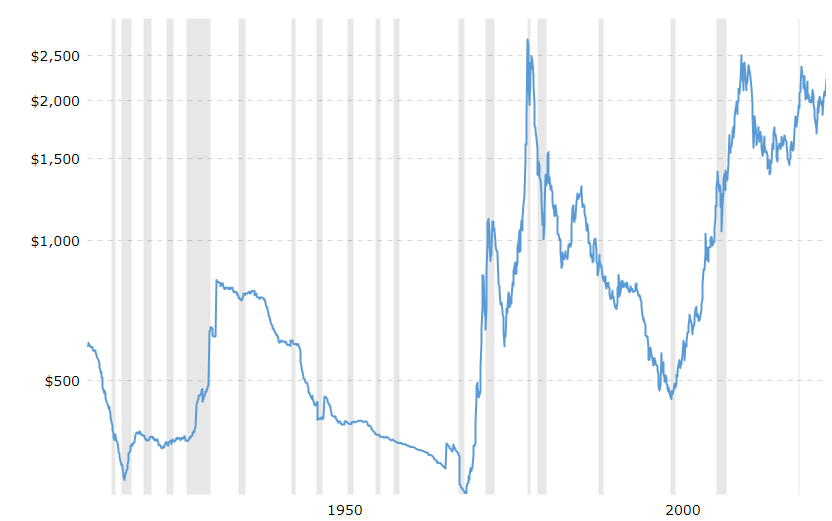

The Eternal Charm of Precious Metals Investment

Gold’s Unwavering Attraction

Gold’s historical significance is unmatched, revered across ages as a bastion of wealth and a hedge against economic upheaval. Its inherent worth stands resilient against the test of time, making it a coveted asset for those seeking to insulate their wealth from inflation and market instabilities.

Weighing Investment Avenues

The venture into precious metals, while rewarding, demands a careful assessment of its benefits and considerations. Factors such as liquidity, potential costs for storage, and tax implications should be judiciously evaluated to align with one’s investment strategy and goals.

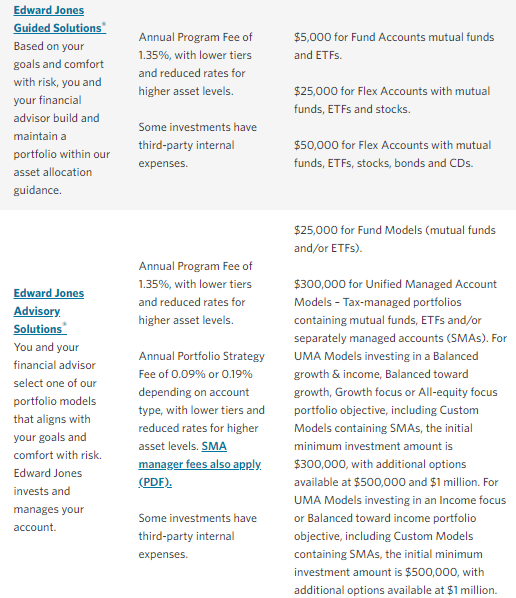

Understanding Edward Jones Fees: The Breakdown

Edward Jones is transparent about its fee structure, ensuring investors are well-informed about their investment costs. Here’s a detailed look at the various fees associated with Edward Jones IRA accounts:

– Account Setup Fees

Initially, opening an IRA with Edward Jones might involve a one-time setup fee. This fee covers the administrative costs of establishing your new IRA account.

– Annual Account Fees

Edward Jones charges an annual account fee for the maintenance of your IRA, which can vary depending on your account balance and the type of IRA you choose.

– Transaction Fees

Every time you buy or sell investments within your IRA, Edward Jones may charge transaction fees. These fees compensate the firm for executing trades on your behalf.

– Fund Management Fees

If your IRA invests in mutual funds or other managed investment products, expect to incur fund management fees. These fees are paid out of your investment returns and go towards the cost of professional fund management.

Comparing Edward Jones IRA Fees with Industry Standards

When considering Edward Jones for your IRA, it’s helpful to compare its fees with other brokerage firms. On average, Edward Jones’ fees are competitive, offering value for the personalized investment advice and portfolio management services it provides. However, it’s important for investors to weigh these costs against the potential benefits of investing with Edward Jones.

How to Minimize Edward Jones IRA Fees

Investors can adopt several strategies to minimize the impact of fees on their Edward Jones IRA accounts:

- Choose Low-Cost Investments: Opting for investments with lower transaction fees and fund management fees can help reduce overall costs.

- Consolidate Accounts: Consolidating multiple retirement accounts into a single Edward Jones IRA may reduce the total amount of annual account fees.

- Negotiate Fees: In some cases, investors may be able to negotiate lower fees based on their account size or relationship with Edward Jones.

The Real Cost of Investing: Edward Jones IRA Fees vs. Returns

While fees are an important consideration, it’s also crucial to evaluate the overall return on your investments. High fees can sometimes be justified by superior investment performance or personalized financial advice. Thus, investors should look beyond the fees and consider the value added by Edward Jones in achieving their retirement goals.

Final Thoughts: Is Edward Jones IRA Right for You?

Deciding if an Edward Jones IRA is right for you depends on several factors, including your investment preference, need for personalized advice, and fee sensitivity. It’s important to assess both the costs and benefits of investing with Edward Jones before making a decision.

Call to Action: Start Planning Your Retirement Today

Preparing for retirement is a crucial aspect of financial planning. If you’re considering opening an IRA, take the time to understand the associated fees and how they fit into your investment strategy. Contact an Edward Jones financial advisor today to discuss your retirement planning needs and learn more about the options available to you.

A Critical Review of Edward Jones Gold IRA: Weighing the Scales

Advantages and Limitations

Edward Jones distinguishes itself through unparalleled customer service and expertise in wealth management. However, its specialty services and fee structures may not universally align with every investor’s expectations. Hence, Edward Jones Gold IRA caters supremely to those desiring personalized, advisory-driven investment experiences, as opposed to investors seeking more economically flexible alternatives.

Deciphering Client Experiences

Opinions on Edward Jones Gold IRA span a broad spectrum, with praise for its dedication to client fulfillment counterbalanced by critiques on aspects like fee transparency and advisor engagement. It becomes essential for potential investors to embark on a thorough exploration to ascertain whether Edward Jones aligns with their investment aspirations.

Conclusion: Steering Through the Investment Terrain

Conclusively, Edward Jones Gold IRA stands as a formidable entity in wealth management, tailored for an elite client base. Its commitment to personalized service is unparalleled, yet the judicious investor must navigate the nuances of its offerings and fee structures. By considering alternative gold IRA companies and meticulously planning their investment strategies, individuals can venture into the investment domain with confidence, poised to make informed, strategic decisions.

FAQs

- Does Edward Jones offer self-directed Gold IRAs?

- Edward Jones does not offer self-directed Gold IRAs but facilitates investments in gold through stocks in gold mining companies and gold-related ETFs.

- How does Edward Jones differentiate from other investment firms?

- Edward Jones is celebrated for its customized wealth management approach, prioritizing face-to-face advisory services to serve high-net-worth individuals uniquely.

- Can investing in precious metals provide tax benefits?

- Yes, investing in precious metals can yield tax advantages, dependent on the investment account and strategy used. It’s advisable to consult a financial advisor for detailed insights.

- What significance do custodians have in Gold IRAs?

- Custodians are integral to Gold IRAs, overseeing the secure storage and management of precious metals, ensuring regulatory compliance, and protecting investor interests.

- How should investors evaluate Edward Jones for their financial objectives?

- Prospective investors are encouraged to thoroughly research Edward Jones’s investment opportunities, fee structures, and client reviews. Aligning these insights with personal investment goals and risk tolerance is crucial for making informed financial decisions.