Introduction to Charles Schwab Gold IRA

Investing in gold has long been seen as a safeguard against inflation and a way to diversify investment portfolios. Charles Schwab, a leading financial services company, offers comprehensive solutions for setting up and managing Gold IRAs.

While Schwab itself doesn’t offer physical gold IRAs directly, they provide the necessary guidance and facilitate the process through partnerships with custodians that specialize in precious metals.

This guide explores the Charles Schwab Gold IRA, including how you can integrate gold and other precious metals into your retirement planning.

Table of Contents

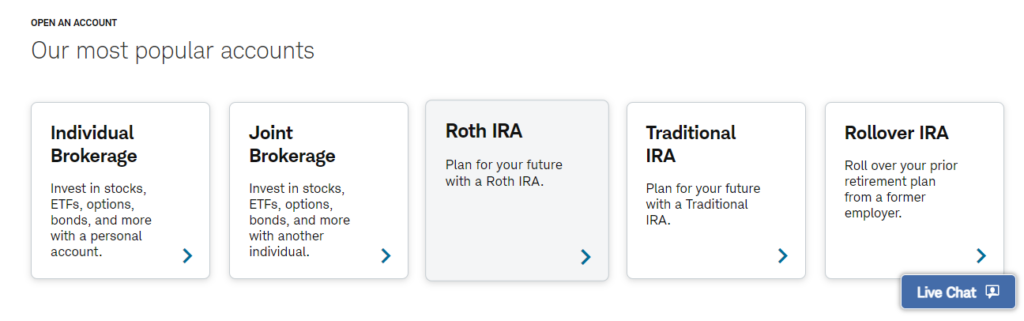

2. How to Set Up a Gold IRA with Charles Schwab

Eligibility Requirements

Thinking about securing your financial future with a Gold IRA at Charles Schwab?

First things first—let’s talk eligibility. Not everyone can open a Gold IRA, so it’s essential to know if you qualify.

Typically, eligibility is straightforward. You need to be a US citizen, have a Social Security number, and be of legal age (18 and above). Most importantly, it’s about having earned income. Yes, even if you’re in retirement, you can potentially still qualify as long as you the income criteria.

That said, it’s always good to double-check with a financial advisor at Charles Schwab. They can provide tailored advice based on your specific situation and goals.

Just think of them as a friendly guide helping you navigate the sometimes-confusing world of retirement investments.

Account Opening Process

So, you qualify, great! Now let’s dive into the actual process of opening your Gold IRA. Setting up a Gold IRA with Charles Schwab isn’t overly complex, but having a clear step-by-step guide can make things smoother.

Step 1: Setup an Account

First, you need to open a self-directed IRA account with Charles Schwab. This can usually be done online or over the phone. Be prepared to fill out some forms and provide basic information like your Social Security number, employment details, and financial goals.

Step 2: Choose a Custodian

Next, you’ll need to pick a custodian. A custodian is like a security guard for your investments—they hold and manage your assets. Charles Schwab Gold IRA typically acts as the custodian, but you might have other options.

Step 3: Funding the Account

Finally, before you can start investing in gold, you’ll need to fund your IRA. We’ll talk more about funding options in the next section, but remember, this step is crucial as it sets the stage for you to buy gold or other precious metals.

Funding Your IRA

Funding your new Gold IRA is where the rubber meets the road. Here are the main ways you can put money into your account.

Cash Contributions

A straightforward method is to make a cash contribution. You can deposit money directly into your IRA, subject to annual contribution limits set by the IRS. For instance, as of 2023, you can contribute up to $6,500 per year or $7,500 if you’re over 50.

Transfers

Already have an IRA with another financial institution? No problem! You can transfer those funds to your new Gold IRA at Charles Schwab without incurring any penalties. Just coordinate with both institutions to smooth out the transition.

Rollovers

If you have a 401(k) from a previous employer, you can roll it over into your Gold IRA. There are specific rules and time-frames you need to follow to avoid penalties.

Typically, you have 60 days from the time you receive the 401(k) funds to deposit them into your Gold IRA.

Personal tip: I once helped a close friend roll over his old 401(k) to a Gold IRA, and seeing him at peace knowing his retirement savings were more secure was incredibly rewarding.

3. Types of Gold Investments Allowed in Charles Schwab

Physical Gold

When considering gold investments, one of the classical and tangible forms you can invest in through Charles Schwab is physical gold. This category primarily includes gold coins and bars, which are allowed in Charles Schwab Gold IRAs

Gold Coins

Gold coins are a popular choice for many investors. These coins come in various weights and designs, making them both an attractive and practical investment.

- American Gold Eagles: These are perhaps one of the most popular gold coins in the U.S., known for their high gold content and beautiful design.

- Canadian Gold Maple Leafs: Recognized for their purity, these coins are another solid option for gold IRA investments.

- South African Krugerrands: These coins are widely accepted and offer a strong value for your investment.

Gold Bars

Gold bars are often the go-to for investors looking to purchase larger amounts of gold. They range from small, manageable sizes to hefty bars worth significant sums.

- 1-ounce bars: These are small but valuable, offering flexibility for smaller investments.

- 10-ounce bars: A more substantial way to own gold, ideal for those looking to hold more significant amounts.

- Kilogram bars: The best option if you’re planning to make a serious commitment to gold investment.

“Holding physical gold gives you a real, tangible asset that you can hold in your hand, offering a unique sense of security and ownership.”

Gold ETFs and Mutual Funds

Switching gears a bit, let’s delve into the world of gold ETFs and mutual funds. While these don’t give you physical gold, they do offer an interesting way to invest in this precious metal.

Pros of Gold ETFs and Mutual Funds

- Liquidity: One of the biggest advantages is liquidity. You can easily buy and sell shares without worrying about the physical storage of gold.

- Cost-Effective: These investments generally have lower fees compared to owning physical gold, making it easier on your wallet.

- Diversification: You get exposure to a range of gold-related assets, spreading out the risk.

Cons of Gold ETFs and Mutual Funds

- No Physical Ownership: Unlike physical gold, you won’t have a tangible asset to hold.

- Market Risks: They’re still subject to market risks and can fluctuate based on a variety of factors beyond just the gold price.

- Management Fees: Even though the fees are lower compared to physical gold, they still exist and can eat into your returns over time.

Examples of Popular Gold ETFs and Mutual Funds at Schwab:

- SPDR Gold Shares (GLD): One of the largest and most liquid gold ETFs available.

- iShares Gold Trust (IAU): Another popular ETF with even lower fees than GLD.

- Fidelity Select Gold Portfolio (FSAGX): This mutual fund invests in companies primarily engaged in gold mining.

“Investing in gold ETFs and mutual funds can be a great way to gain exposure to gold without the hassle of physical storage.”

Direct vs Indirect Gold Investments

Understanding the difference between direct and indirect gold investments can help you decide which route aligns best with your investment goals.

Direct Gold Investments

Direct investments involve the physical purchase of gold, such as coins and bars.

- Pros:

- Tangible Asset: You get to hold the gold, providing a unique sense of ownership and security.

- No Counterparty Risk: Since you own the gold outright, there’s no risk of a third-party defaulting.

- Cons:

- Storage and Insurance: You’ll need a secure place to store your gold, and insurance costs can add up.

- Liquidity Issues: Selling physical gold can be more cumbersome compared to liquidating ETFs or mutual funds.

Indirect Gold Investments

Indirect investments involve purchasing financial instruments related to gold, such as ETFs and mutual funds.

- Pros:

- Ease of Investment: It’s easier to buy and sell these instruments, offering higher liquidity.

- Lower Costs: No worries about storage or insurance costs.

- Cons:

- No Physical Ownership: You won’t have a tangible asset.

- Market Risks: These investments come with their own set of market risks and are not as straightforward as owning physical gold.

“Direct vs Indirect gold investments are like owning a house versus owning a share in a real estate company — each has its own set of benefits and drawbacks.”

4. Managing Your Charles Schwab Gold IRA

Investing in gold through a Charles Schwab Gold IRA can be a great way to diversify your retirement portfolio. However, it’s important to know the ins and outs of managing your Gold IRA effectively.

In this post, we’ll explore storage solutions for your physical gold, break down the fees and expenses, and offer tips on monitoring and rebalancing your investments. Let’s dive in!

Storage Solutions: Options for Safekeeping Physical Gold

When you invest in a Charles Schwab Gold IRA, one of your primary concerns will be the storage of your physical gold. Unlike other investments, gold requires a secure storage solution to ensure both safety and regulatory compliance.

Home Storage vs. Professional Vaults

- Home Storage: While the idea of keeping your gold bars under your bed might sound convenient, it’s generally not advisable. Home storage poses risks of theft and could also complicate the tax benefits of your Gold IRA.

- Professional Vaults: The recommended option is to store your gold in a professional vault. Charles Schwab works with various IRS-approved depositories to keep your assets safe. These facilities offer advanced security measures and are fully insured, giving you peace of mind.

Types of Depository Services

- Segregated Storage: Keeps your gold separate from other investors’ assets. This option ensures that the exact items you own will be returned to you.

- Non-Segregated Storage: Your gold is stored with other investors’ assets. While this is usually more cost-effective, you might not receive the exact same bars or coins you deposited.

“Opting for professional vault storage not only keeps your gold safe but also ensures that you comply with IRS regulations.“

Fees and Expenses: Breakdown of Costs Associated with Managing a Charles Schwab Gold IRA

Understanding the costs involved will help you make informed decisions and avoid any unpleasant surprises down the road.

Upfront Costs

- Account Setup Fee: When you first open a Charles Schwab Gold IRA, you might encounter an account setup fee. This is a one-time charge to get your account up and running.

- Purchase Fees: When you purchase gold for your IRA, there could be dealer markup fees to consider. It’s advisable to shop around and find a dealer with reasonable rates.

Ongoing Costs

- Storage Fees: Professional vault storage isn’t free. You’ll typically incur an annual fee based on the amount of gold you have stored. Segregated storage tends to cost more than non-segregated options.

- Administrative Fees: Managing a Gold IRA involves ongoing administrative work, which could result in annual fees. These fees cover account maintenance, statements, and compliance with IRS regulations.

Hidden Costs

- Selling Fees: When you’re ready to sell your gold, there could be additional fees to consider, including dealer markup.

- Miscellaneous Fees: Some vault providers may charge fees for insurance, auditing, or other services.

“Having a clear understanding of all potential costs helps you make smarter investment choices and manage your Gold IRA more efficiently.”

Monitoring and Rebalancing: Tips on How to Keep Track of Your Investments and When to Rebalance

A Gold IRA isn’t a ‘set it and forget it’ investment. Regular monitoring and occasional rebalancing will keep your portfolio aligned with your financial goals.

Monitoring Your Gold IRA

- Track Performance: Use Charles Schwab’s online tools to keep an eye on the value of your gold investments. Regular updates help you stay informed.

- Review Statements: Regularly review your account statements to make sure all transactions are accurate and fees are transparent.

- Stay Informed: Keep an eye on market trends and global economic conditions that could affect the value of your gold investments.

Rebalancing Your Portfolio

- Annual Reviews: At least once a year, review your investment portfolio to see if it’s aligned with your retirement goals. If gold has become too large or too small a portion of your portfolio, it may be time to rebalance.

- Market Conditions: You might also consider rebalancing if significant market changes occur. For instance, if gold prices soar or plummet, it could be wise to reevaluate your position.

Practical Advice

- Consult with a Financial Advisor: If you’re not sure when or how to rebalance, a financial advisor can offer personalized advice tailored to your individual needs.

- Set Alerts: Many financial platforms, including Charles Schwab, allow you to set price alerts. This can help you make timely decisions without constantly monitoring the market.

“Regularly monitoring and occasionally rebalancing your Gold IRA ensures that your investments remain closely aligned with your long-term goals.”

5. Legal and Tax Implications

Tax Advantages of Gold IRAs

If you’re looking to diversify your retirement portfolio, you might have considered a Charles Schwab Gold IRA. But how does it work from a tax perspective? Let’s break it down in simple terms.

Gold IRAs, much like traditional IRAs, can offer some notable tax advantages. When you invest in a Gold IRA, your investments grow tax-deferred.

This means you won’t have to pay taxes on any gains or dividends until you start withdrawing funds during retirement. This can be a significant benefit if you hold your investments for a long period and allow them to grow.

However, it’s important to note that the tax-deferred status also depends on the type of Gold IRA. If it’s a Roth Gold IRA, for example, contributions are made with after-tax dollars, but withdrawals can be tax-free in retirement, provided certain conditions are met.

This can be quite beneficial for those expecting to be in a higher tax bracket during retirement.

Regulations Surrounding Gold IRAs

Before jumping into a Gold IRA, there are a few regulations you should be aware of to stay compliant and avoid any potential pitfalls.

First, not all gold is eligible for a Gold IRA. According to IRS guidelines, the gold must meet a specific purity standard of 99.5%. Common options include American Gold Eagle coins and Canadian Maple Leaf coins. Be sure the gold you purchase meets these criteria to ensure it qualifies for your IRA.

Second, your Gold IRA must be managed by a custodian. This means you can’t keep the gold in your home or a personal safety deposit box.

Instead, the gold must be stored in an approved depository. Custodians like Charles Schwab can help manage this for you, ensuring that all IRS regulations are met.

Custodial Responsibilities

Another point to consider is that your custodian will handle all transactions involving your Charles Schwab Gold IRA. This includes purchasing the gold, ensuring its proper storage, and even selling it when you’re ready to make a withdrawal. While this adds a layer of security and compliance, it also means you should choose a custodian who is reputable and experienced in handling Gold IRAs.

Required Minimum Distributions (RMDs)

Just like any other traditional IRA, Gold IRAs are subject to Required Minimum Distributions (RMDs). Once you reach the age of 72, the IRS mandates that you begin taking distributions from your retirement accounts, and this includes your Gold IRA.

How It Applies to Gold IRAs

Now, you might wonder how RMDs apply to an account holding physical gold. The process is quite similar but with a few extra steps.

Since your Charles Schwab Gold IRA involves physical assets, you’ll need to valuate the gold based on its market price when calculating your RMD. This can get a bit complicated, so working closely with your custodian is crucial.

Let’s say your total RMD for the year is $5,000, but the value of your gold holdings is increasing. You can either sell a portion of the gold equivalent to the RMD amount or take an “in-kind” distribution. An in-kind distribution means you receive the physical gold instead of cash.

Either way, the RMD amount will be added to your taxable income for the year.

Personal Anecdote

Having dealt with this myself, I can tell you that understanding RMDs for Gold IRAs can initially seem daunting. However, sitting down with a knowledgeable advisor and your custodian can simplify things significantly. The first year I had to take an RMD, I opted for an in-kind distribution. It felt a bit surreal to actually hold gold coins that were part of my retirement fund, but it also made the whole concept more tangible and real.

Reminder: Always consult with a tax professional to understand how these requirements affect your unique financial situation!

6. Planning for the Future

Long-Term Benefits: How Investing in a Gold IRA Impacts Retirement Planning

Investing in a Gold IRA (Individual Retirement Account) can be a smart for your retirement planning. While the thought of putting your hard-earned money into something as traditional gold might seem a bit old-fashioned, it actually comes with a host of long-term benefits.

One major advantage of a Gold IRA is its ability to hedge against inflation. Unlike paper money, which can lose value over time due to inflation, gold tends to maintain its purchasing power. A quick look at history shows that gold prices have generally risen during times of economic uncertainty. This can offer a sense of security, knowing that your retirement savings are safeguarded against fluctuating market conditions.

Another benefit is diversification. Having a mix of different types of investments can help balance your portfolio and reduce risk. Traditional IRAs are typically invested in stocks and bonds, which are subject to market volatility. Including gold in your retirement savings can act as a buffer during market downturns, adding an element of stability.

Lastly, investing in a Gold IRA offers tax advantages. Depending on the type of IRA you choose (Traditional or Roth), you can either defer taxes on your gains until withdrawal or enjoy tax-free growth on your investments.

Risk Management: How to Mitigate Risks Associated with Gold Investing

Just like any other form of investment, putting your money into a Gold IRA comes with its own set of risks. But don’t worry, there are several strategies to help mitigate those risks.

First off, it’s essential to do your homework. This might sound obvious, but understanding the basics of gold investing can save you a lot of trouble down the line. Look into reputable companies that specialize in Gold IRAs and consult with a financial advisor who has experience with precious metals.

Diversification isn’t just a buzzword; it’s a crucial strategy in risk management. While it might be tempting to put all your eggs in one basket, balancing your Gold IRA with other types of investments can mitigate those risks. Try to keep a healthy mix of assets, such as stocks, bonds, and real estate, alongside your gold investments.

Storage security is another key consideration. Gold is a physical asset, and you need to think about where you’ll store it. Many Gold IRA providers offer secure storage options, but it’s worth doing some extra research to ensure that your precious metals are kept in a safe place.

Finally, keep an eye on market trends and reevaluate your retirement plan periodically. This way, you can make necessary adjustments to keep your strategy aligned with your long-term goals.

Integrating Gold with Other Retirement Assets: Strategies for Blending Gold Investments with Other Retirement Funds

Blending gold investments with other retirement assets can be a delicate balance, but once you get it right, it can make a world of difference to your financial future.

One of the first steps is to determine what percentage of your portfolio you want to allocate to gold. Financial experts generally recommend keeping your gold investments between 5% and 10% of your total retirement portfolio. This allows you to enjoy the benefits of gold while still maintaining diversification.

Next, consider leveraging mutual funds and ETFs that focus on gold. These can be excellent options for those who want to gain exposure to gold without the hassle of physical storage. The best part is that these funds also offer the added diversification of investing in companies that mine or produce gold.

Another strategy is to look at gold-related stocks. Investing in companies that mine or deal in gold can provide you with indirect exposure to gold prices. This can be particularly beneficial if you’re looking to enhance your retirement portfolio without adding too much physical gold.

If you’re comfortable with the idea, consider investing in gold futures and options. Though these can be riskier, they offer the potential for higher returns. However, it’s advisable to consult with your financial adviser before stepping into this domain.

Incorporating gold into your overall retirement plan doesn’t have to mean foregoing other types of investments. You can have the best of both worlds—a diverse portfolio that gives you the potential for growth and stability.

Remember, your future self will thank you for the thoughtful planning you do today! Whether you’re a seasoned investor or just getting started, considering a Gold IRA might be the golden ticket to a prosperous retirement.

With these insights and strategies, you can walk confidently into your golden years, knowing you’ve made sound decisions for your future. Good luck, and happy investing!

Summary and Conclusion

- Why Choose Charles Schwab Gold IRA: We discussed why Charles Schwab is a trusted name in the financial world. Their excellent customer service, educational resources, and transparent fee structure were notable highlights.

- How to Get Started: We outlined the practical steps for setting up a Gold IRA with Charles Schwab, from initial consultations to rolling over existing retirement accounts.

Final Thoughts on the Value of a Charles Schwab Gold IRA in Retirement Planning

Now that we’ve revisited the key points, let’s discuss why a Charles Schwab Gold IRA might be a valuable addition to your retirement planning strategy. Retirement planning is all about securing your financial future, and a diversified approach can provide a balanced risk-to-reward ratio.

Imagine enjoying your golden years without the constant worry of market volatility. Gold has historically held its value over time, acting as a cushion against economic downturns. By choosing Charles Schwab, you’re not only getting access to a reliable Gold IRA but also benefiting from decades of financial expertise and trustworthy service. It’s like having a financial partner who genuinely has your best interests at heart.

Choosing a Gold IRA might seem like a substantial step initially. Still, the peace of mind you’ll get from knowing that part of your retirement savings is in a tangible asset can be quite rewarding. And with Charles Schwab Gold IRA guiding you every step of the way, you can make informed decisions that align with your retirement goals.

“A Charles Schwab Gold IRA could be the golden ticket to a more secure and worry-free retirement.”

Feel free to reach out to Charles Schwab to see how a Gold IRA can fit into your overall retirement strategy. Your future self will thank you!

Frequently Asked Questions

Are there penalties for early withdrawal from a Gold IRA?

Absolutely, penalties can be a concern when it comes to withdrawing from your Gold IRA before you hit retirement age. The IRS isn’t exactly forgiving when it comes to early withdrawals.

Key Points to Consider:

• Under 59 ½ Rule: Withdrawing funds before this age can result in a 10% early withdrawal penalty.

• Taxable Income: Early withdrawals are also considered taxable income, meaning you’ll owe income taxes on the amount.

This could mean if you pull out, say, $10,000, you’ll not only pay penalties but also increase your taxable income for the year. So it might feel like you’re losing twice.

Exceptions to the Rule:

There are some instances, like severe medical expenses or disabilities, where penalties can be waived. However, it’s always a good idea to consult with a financial advisor to avoid any unexpected surprises.

How does Charles Schwab Gold IRA compare to other Gold IRA facilitators?

Charles Schwab is a well-known name in the realm of investments, but when it comes to Gold IRAs, how does it stack up against the competition?

Pros:

• Reputation: Schwab has a long-standing reputation which adds a layer of trust.

• Wide Range of Services: Besides Gold IRAs, they offer a multitude of other investment options.

• Customer Service: Renowned for having excellent customer service.

Cons:

• Specialization: Other companies specialize exclusively in Gold IRAs, which might offer more in-depth expertise.

• Fee Structures: Their fee structures might not be as competitive as those focusing solely on precious metals.

Competitors:

• Regal Assets: Known for great customer service and competitive fees specific to Gold IRAs.

• Birch Gold Group: Offers a lot of educational resources and has good customer feedback.

You might feel like you’re walking into a buffet with too many options, but that’s where doing your homework pays off. Charles Schwab is like the classic dish you know and love—reliable, but sometimes it’s nice to explore other specialties.

Can I transfer existing retirement accounts into a Gold IRA?

Yes, you can transfer your existing retirement accounts like Traditional IRAs, Roth IRAs, 401(k)s, and 403(b)s into a Gold IRA.

Process:

• Initiate a Rollover: Contact your current retirement account administrator and initiate a rollover.

• Custodian Help: Your Gold IRA custodian will help you with the paperwork and ensure a seamless transfer.

• Direct vs Indirect Rollovers: Direct rollovers are less susceptible to IRS penalties compared to indirect rollovers.

Things to Keep in Mind:

• 60-Day Rule: Ensure your funds are transferred within 60 days to avoid taxes and penalties.

• Custodian Fees: Be aware of fee structures, as they can vary widely.

Turning your existing retirement savings into a Gold IRA could be a move that adds resilience to your financial future. It’s like packing a safety net in your financial backpack.

Pingback: Why Transferring IRA to Gold is a Smart Move in 2024