Introduction

Are you ready to take control of your retirement savings and protect your financial future against economic uncertainties? Introducing the Birch Gold IRA—a powerful investment tool designed to safeguard and grow your wealth through the stability of precious metals.

In this comprehensive guide, we’ll explore what a Birch Gold IRA is, delve into its benefits, and show you why diversifying your retirement portfolio with gold could be the smartest move you make for your golden years.

Join us as we unlock the potential of precious metals and set the foundation for a secure and prosperous retirement.

Table of Contents

What is a Birch Gold IRA?

A Birch Gold Individual Retirement Account (IRA) is a type of savings account that offers significant tax advantages for those looking to save for retirement. The primary benefit of an IRA is that it allows your investments to grow either tax-deferred or tax-free, depending on the type of IRA you choose. Traditional IRAs typically defer taxes on the earnings until withdrawal, while Roth IRAs provide potentially tax-free growth, as withdrawals are tax-free in retirement assuming certain conditions are met.

Birch Gold Group’s Tailored IRA Options

A Birch Gold IRA specifically refers to a precious metals IRA offered by Birch Gold Group, a leading provider in the field of precious metals investment. This specialized IRA allows individuals to hold physical precious metals like gold, silver, platinum, and palladium within their retirement accounts. Unlike traditional IRAs invested primarily in stocks and bonds, a Birch Gold IRA provides an opportunity to diversify retirement portfolios with assets that tend to perform well during periods of economic uncertainty or high inflation.

Here’s how Birch Gold Group tailors these IRAs:

- Diversification: Birch Gold Group emphasizes the importance of diversification in retirement planning. Investing in precious metals through an IRA can protect against the volatility of traditional markets, as precious metals often move inversely to paper assets.

- Security: Precious metals have historically been a safe haven asset. Birch Gold Group provides secure storage options for the physical metals in your IRA, ensuring that your investments are safe and fully insured.

- Expertise: Birch Gold Group offers expert guidance on which metals are best suited for your investment goals and how to strategically purchase them to comply with IRS regulations. This includes help in choosing the right mix of gold, silver, platinum, and palladium.

- Flexibility: With a Birch Gold IRA, you have the flexibility to buy, sell, and trade your metals as needed to adjust your investment strategy based on market conditions or personal circumstances.

Introduction to Birch Gold Group

Birch Gold Group, established in 2003, is a well-regarded company in the precious metals market, specializing in gold, silver, platinum, and palladium. Based in Burbank, California, the company has built a strong reputation over the years for its commitment to helping clients diversify their investment portfolios through precious metals.

History and Background

From its inception, Birch Gold Group has focused on customer education and secure investment options. The company started with a mission to provide investors with a robust method to protect their retirement savings from the volatility of traditional financial markets. Over the years, Birch Gold Group has expanded its services, catering to an increasing number of clients looking for reliable investment options in uncertain economic times

Who Owns Birch Gold Group

Birch Gold Group does not publicly disclose detailed ownership information as it is a privately held company. Typically, information about the ownership of private companies like Birch Gold Group can be limited unless shared directly by the company. For the most accurate and up-to-date information regarding their ownership or corporate structure, it’s best to contact Birch Gold Group directly or check their official website and company filings if available.

Services and Focus on Precious Metals IRAs

Birch Gold Group offers a variety of services tailored to the needs of individual investors. Their primary focus is on Precious Metals IRAs. This service allows individuals to hold physical gold, silver, platinum, and palladium in their retirement accounts, rather than just stocks and bonds. The company guides clients through every step of the process, from the initial decision to invest in metals, to the selection of products, and the final purchase.

The group’s services include:

- IRA Rollovers: Birch Gold Group specializes in rolling over existing retirement accounts into Precious Metals IRAs without tax penalties, making the transition smooth and straightforward.

- Direct Purchases: For investors wishing to own physical metals outside of a retirement account, Birch Gold IRA offers direct purchase options, with secure storage and direct delivery.

- Personalized Consultation: Understanding that each investor’s needs are unique, Birch Gold provides personalized consultation to ensure that each client’s financial goals and investment strategies are met.

Birch Gold Group has maintained a strong focus on compliance and education, ensuring that their clients understand the intricacies of precious metals investment and the specific regulations related to precious metals IRAs. This commitment to client service and education has positioned Birch Gold Group as a trusted leader in the precious metals industry.

Birch Gold IRA Products

When considering retirement investment options, Birch Gold Group offers a diverse range of Individual Retirement Account (IRA) products focused on precious metals. These products are designed to provide investors with a secure and stable investment option, particularly suitable for those looking to diversify their retirement savings away from more traditional stock and bond investments. This segment explores the variety of Birch Gold IRA products available and the specific types of precious metals you can invest in.

Types of IRAs Offered by Birch Gold Group

Birch Gold Group specializes in Precious Metals IRAs, which are self-directed IRAs that allow individuals to hold physical precious metals in their retirement accounts. The most common types of IRAs offered include:

- Traditional IRA: Contributions are often tax-deductible, and the investments grow tax-deferred until withdrawal during retirement.

- Roth IRA: Contributions are made with after-tax dollars, but withdrawals during retirement are tax-free, including the gains.

- SEP IRA: Designed for self-employed individuals and small business owners, offering higher contribution limits.

- Simple IRA: Suitable for small businesses, allowing both employer and employee contributions.

Each of these accounts allows for the inclusion of precious metals as part of the retirement portfolio, providing an excellent way to hedge against inflation and economic uncertainty.

Precious Metals Available for Investment

Investing through Birch Gold Group gives you access to a variety of precious metals, including:

Gold Products

- Gold Coins: Includes various options like the American Eagle, Canadian Maple Leaf, and Austrian Philharmonic.

- Gold Bars: Offers gold bars of various sizes from reputable mints and refiners that meet IRS purity standards.

Silver Products

- Silver Coins: Offers coins such as the American Silver Eagle, Canadian Silver Maple Leaf, and the Australian Silver Kangaroo.

- Silver Bars: Provides silver bars in various sizes that also meet purity requirements for IRA investments.

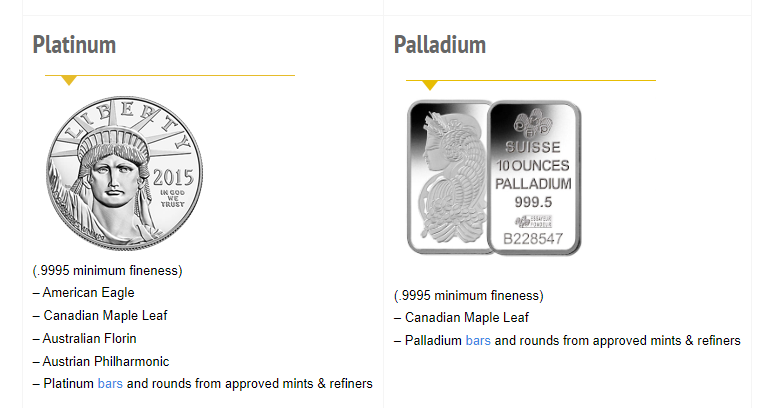

Platinum and Palladium Products

- Platinum Options: Includes products like the American Platinum Eagle and Canadian Platinum Maple Leaf.

- Palladium Options: Features items such as the Canadian Palladium Maple Leaf.

Pros and Cons of Investing with Birch Gold Group

| Aspect | Advantages of Choosing Birch Gold Group | Potential Drawbacks or Considerations |

|---|---|---|

| Diversification | Offers a valuable opportunity to diversify investment portfolios beyond traditional stocks and bonds. Investing in precious metals can protect against inflation and economic downturns. | |

| Expertise | Known for its expertise in the precious metals market with years of experience, providing knowledgeable advice and assistance based on current trends and long-term forecasts. | |

| Investment Options | Provides a variety of precious metal products including coins and bullion. Their IRA options are compliant with IRS regulations, ensuring investments are secure and legally sound. | |

| Customer Service | Prides itself on excellent customer service, offering personalized guidance throughout the process of setting up an IRA, rolling over existing retirement accounts, and selecting the right metals. | |

| Education | Offers extensive educational materials to help clients understand the nuances of precious metals investment, beneficial for new investors. | |

| Fees and Costs | Investors need to be aware of various fees such as setup fees, annual storage fees, and management fees, which might be higher than traditional IRA investments. | |

| Market Volatility | Precious metals can be volatile; prices like those of silver and platinum can fluctuate significantly, potentially impacting investment value, especially in the short term. | |

| Liquidity | Selling precious metals can be less liquid than stocks or bonds, potentially making it harder to quickly convert metals back into cash if needed urgently. | |

| Income Generation | Unlike stocks, precious metals do not generate income through dividends or interest; investment return is solely based on price appreciation. | |

| Storage & Insurance | Physical metals require secure storage and insurance, adding to the cost and complexity of investing. While Birch Gold Group facilitates these services, they are additional factors to consider. |

Birch Gold IRA Fees Explained

When considering an investment in a Birch Gold IRA, understanding the Birch Gold fees structure is crucial. These fees can impact the overall returns on your investment, so it’s important to know how they compare to industry standards. Here, we provide a detailed breakdown of the fees associated with Birch Gold IRAs and compare them to typical costs in the industry.

Breakdown of Birch Gold Group IRA Fees

1. Setup Fees: Birch Gold Group charges a one-time account setup fee when you open a new IRA. This fee covers the administrative costs associated with establishing your account. The exact fee can vary, but it’s generally in the range of $50 to $90.

2. Annual Administrative Fees: There is an annual fee to maintain your IRA, which covers the administrative services provided by Birch Gold Group. This fee usually ranges from $80 to $150, depending on the complexity and size of your account.

3. Storage Fees: Since precious metals must be stored in a secure facility, Birch Gold Group charges an annual storage fee. This fee varies based on whether the storage is segregated (each investor’s holdings are stored separately) or non-segregated (holdings are co-mingled). Typically, the storage fee ranges from $100 to $300 per year.

4. Insurance Fees: To protect your investment against loss or theft, insurance is required for the stored metals. This cost is often included in the storage fee, but it’s important to confirm this as practices can vary.

Comparison with Industry Averages

1. Setup Fees: The industry average for setup fees ranges from $50 to $100, making Birch Gold Group’s fees competitive and within the standard range.

2. Annual Administrative Fees: Many precious metals IRA providers charge annual administrative fees that range from $75 to $250. Birch Gold Group’s fees are again within this range, leaning towards the more affordable side, especially for larger accounts.

3. Storage Fees: Industry storage fees typically range from $100 to $300 annually. Birch Gold Group’s fees are competitive, particularly for segregated storage, which is often more expensive than non-segregated options offered by other firms.

4. Insurance Fees: These are generally included in the storage fees across the industry, and Birch Gold Group follows this standard practice, ensuring that their insurance costs are transparent and not excessive.

How to Open a Birch Gold IRA

Opening a Birch Gold IRA can be an excellent way to secure your retirement savings with the stability of precious metals. Here’s a straightforward, step-by-step guide on how to set up a Birch Gold IRA, including the required documents and eligibility criteria.

Step-by-Step Guide on Setting up a Birch Gold IRA

Step 1: Initial Consultation

- Contact Birch Gold Group: Reach out via their website or phone to initiate a conversation.

- Consultation: Discuss your current financial situation, retirement goals, and interest in precious metals with a Birch Gold representative. They will help you understand your options and the benefits of a Gold IRA.

- IRA Application: Fill out an application form to establish a new self-directed IRA. Birch Gold Group will assist you in this process, ensuring all details are correctly handled.

- Transfer Funds: Arrange for the transfer of funds from your existing retirement accounts into your new Gold IRA. This can be done via a direct rollover or a transfer, depending on your current setup.

Step 3: Selecting Your Metals

- Choosing Metals: Select the types of gold or other precious metals you want to include in your IRA. Birch Gold Group offers a range of IRS-approved options and provides guidance on the best choices for your investment goals.

- Purchase: Once you’ve made your selection, Birch Gold will facilitate the purchase of your chosen metals.

Step 4: Storing Your Metals

- Storage Arrangement: All precious metals in an IRA must be stored in an IRS-approved depository. Birch Gold Group will help you set up an account with an approved facility, ensuring your investments are securely stored and compliant with IRS regulations.

Step 5: Ongoing Management

- Statements and Reviews: You will receive regular statements detailing your holdings and their value. Birch Gold also offers ongoing consultation to review your investment performance and make adjustments as needed.

Required Documents and Eligibility Criteria

Documents Needed:

- Identification: A valid government-issued ID, such as a driver’s license or passport.

- Financial Statements: Recent financial statements from any current retirement accounts to facilitate transfers.

- Application Forms: Completed application forms for opening a new IRA and purchasing precious metals.

Eligibility Criteria:

- Age and Earnings: Generally, any individual with earned income who is under the age of 70½ can open a traditional IRA. Roth IRA eligibility depends on income limits.

- Contribution Limits: Contributions to a Gold IRA are subject to the same limits as traditional and Roth IRAs. For 2023, the limit is $6,000 per year, or $7,000 if you are age 50 or older.

Birch Gold IRA Reviews

Birch Gold Group is recognized in the industry for its customer service and extensive expertise in precious metals. In this section, we will summarize the general sentiment expressed in customer birch gold reviews and expert ratings, as well as highlight specific testimonials and case studies that showcase the company’s performance and reliability.

Overview of Customer Reviews and Expert Ratings

Customer Satisfaction: Birch Gold Group typically receives high marks for customer satisfaction. Customers often praise the company for its educational approach, taking the time to explain investment options and the specifics of precious metals IRAs without pressure. Reviews frequently mention the professionalism and helpfulness of the staff, which enhances the overall customer experience.

Expert Endorsements: Many financial experts and independent review sites give Birch Gold Group favorable ratings. The company is praised for its transparency in pricing, the simplicity of its IRA setup process, and its rigorous security measures for storing precious metals. Experts also note Birch Gold Group’s compliance with industry standards and regulations, which bolsters its reputation as a trusted entity in the precious metals market.

Accreditations: Birch Gold Group is accredited by several reputable organizations within the financial and investment industries, including the Better Business Bureau (BBB), where it holds an A+ rating. Such endorsements reflect a commitment to ethical business practices and customer service.

Birch Gold IRA Investment Strategies

Investing in precious metals through Birch Gold Group can be a strategic move for many investors, particularly those looking to diversify their retirement portfolios. This section provides valuable tips and strategies for optimizing precious metals investments with Birch Gold Group and discusses how to balance a portfolio with these assets for retirement.

Understanding the Role of Precious Metals in a Portfolio

1. Diversification: Precious metals like gold and silver are known for their low correlation with traditional financial assets like stocks and bonds. This characteristic can help reduce overall portfolio risk, providing a buffer against market volatility and economic downturns.

2. Inflation Hedge: Historically, precious metals have maintained their value over the long term, making them a solid hedge against inflation. As the cost of living increases, the value of gold and other metals typically rises.

3. Wealth Preservation: Precious metals are considered a store of value. For those nearing retirement or planning for long-term wealth preservation, allocating a portion of their portfolio to precious metals can protect against wealth erosion.

Strategic Tips for Precious Metals Investment

1. Decide on Allocation: Financial experts typically recommend allocating 5-20% of your portfolio to precious metals, depending on your risk tolerance, investment horizon, and economic outlook. It’s important to tailor this percentage to your specific financial goals and needs.

2. Choose the Right Metals: While gold is the most popular choice due to its stability and market liquidity, silver, platinum, and palladium offer different benefits and risks. Silver, for instance, has industrial demand which can influence its price dynamics, while platinum and palladium are rarer and may have more volatile markets.

3. Consider Timing: While it’s difficult to time the market perfectly, paying attention to market trends and economic indicators can provide valuable insights. Precious metals often perform well during periods of uncertainty or when inflation is rising.

4. Review Regularly: As with any investment, regular review and rebalancing are crucial. This ensures that your precious metals holdings remain aligned with your overall investment strategy and account for any changes in your financial situation or the broader economic landscape.

Balancing a Portfolio with Precious Metals for Retirement

1. Start Early: Incorporating precious metals early in your retirement planning allows more time for your investment to grow and adjust to market fluctuations. Early investment also enables compounding benefits on other assets by potentially reducing overall portfolio volatility.

2. Mix Physical and Paper Investments: While owning physical gold and silver adds tangible security, paper investments (like ETFs or mining stocks) in precious metals can offer additional liquidity and ease of trading. Birch Gold Group can advise on suitable options.

3. Use Tax-Advantaged Accounts: Investing in precious metals through an IRA or other tax-advantaged accounts can maximize post-tax returns on these investments. Birch Gold Group specializes in facilitating such investments, ensuring compliance with IRS regulations.

4. Stay Informed: Keeping informed about both the precious metals market and broader financial news can help you make timely adjustments to your portfolio. Birch Gold Group provides educational resources and expert advice to aid in this endeavor.

Comparative Analysis: Birch Gold Group vs. Goldco vs. Augusta Precious Metals

Below is a comparative analysis of Birch Gold Group, Goldco, and Augusta Precious Metals, three prominent players in the precious metals IRA market.

| Feature | Birch Gold Group | Goldco | Augusta Precious Metals |

|---|---|---|---|

| Services Offered | Precious metals IRAs, direct purchase of metals | Precious metals IRAs, direct purchase, cryptocurrency IRAs | Precious metals IRAs, direct purchase of metals |

| Reputation | High customer satisfaction, A+ rating from BBB | Strong reputation, A+ BBB rating, numerous awards | Excellent customer service, A+ BBB rating |

| Expertise | Long-standing expertise in precious metals | Specializes in retirement saving through precious metals and cryptocurrencies | Focuses on customer education in precious metals investment |

| Educational Resources | Extensive resources, including guides and expert advice | Offers a range of educational materials on precious metals and retirement planning | Strong emphasis on personalized customer education and webinars |

| Fees | Competitive fees, transparent pricing | Transparency in fee structure, competitive rates | No management fees, transparent storage and setup fees |

| Customer Service | Personalized service, high accessibility | Praised for customer support and personal account managers | Known for high-level customer interaction and lifetime customer support |

| Unique Selling Points | Diverse range of IRA-eligible precious metals, strong emphasis on customer education | Strong focus on securing retirement with both precious metals and cryptocurrencies | Personalized approach with one-on-one educational sessions |

| Storage Options | Segregated and non-segregated storage available | Segregated storage | Segregated storage only, with high security |

| Investment Minimums | $10,000 for IRAs, $5,000 for direct purchases | $25,000 for IRAs | $50,000 for IRAs |

| Product Variety | Gold, silver, platinum, palladium | Gold, silver, some platinum and palladium | Specializes in gold and silver, limited other metals |

Key Differentiators and Unique Selling Points of Birch Gold IRA

1. Educational Commitment: Birch Gold Group stands out for its commitment to educating its clients. The company provides comprehensive guides and personal consultations to ensure investors are well-informed about their investment choices.

2. Customer-Centric Services: Birch Gold Group is known for its exceptional customer service. They offer a personalized service model that ensures each client receives tailored advice suited to their individual investment needs.

3. Diverse Investment Options: Unlike some competitors who have higher minimum investment requirements, Birch Gold Group offers a more accessible entry point for both IRAs and direct purchases, making it easier for a wider range of investors to start investing in precious metals.

4. Flexible Storage Solutions: Offering both segregated and non-segregated storage options gives investors flexibility in how they want to secure their investments, depending on their security preference and budget.

This comparative analysis shows how Birch Gold Group positions itself as a leader in the precious metals IRA market through its customer-focused services, educational resources, and competitive pricing structure.

Conclusion

In summary, Birch Gold IRA offers a robust platform for those interested in investing in precious metals IRAs. With its strong emphasis on customer education, competitive fee structures, and a variety of investment and storage options, Birch Gold Group stands out in the precious metals market. Whether you’re a seasoned investor or new to precious metals, Birch Gold Group provides the resources, expertise, and personalized service necessary to make informed investment decisions and effectively manage your retirement portfolio. This makes Birch Gold Group a compelling choice for anyone looking to diversify their investment strategy with precious metals.